Pick Up

1382. Recent Fertilizer Market Trends

1382. Recent Fertilizer Market Trends

FAO's Food Outlook report provides an outlook for production and consumption, input costs, prices, and trade in the recent global fertilizer market.

After two years of decline, including a price spike in 2022, global fertilizer use is expected to increase by 6% to 200 million tonnes in 2024, slightly below the 2020 record high of 203 million tonnes. Nitrogen use reached a record high of 115 million tonnes, 2 million tonnes higher than in 2020. This increased the global average fertilizer application rate by 2 kg per hectare across all cultivated crops.

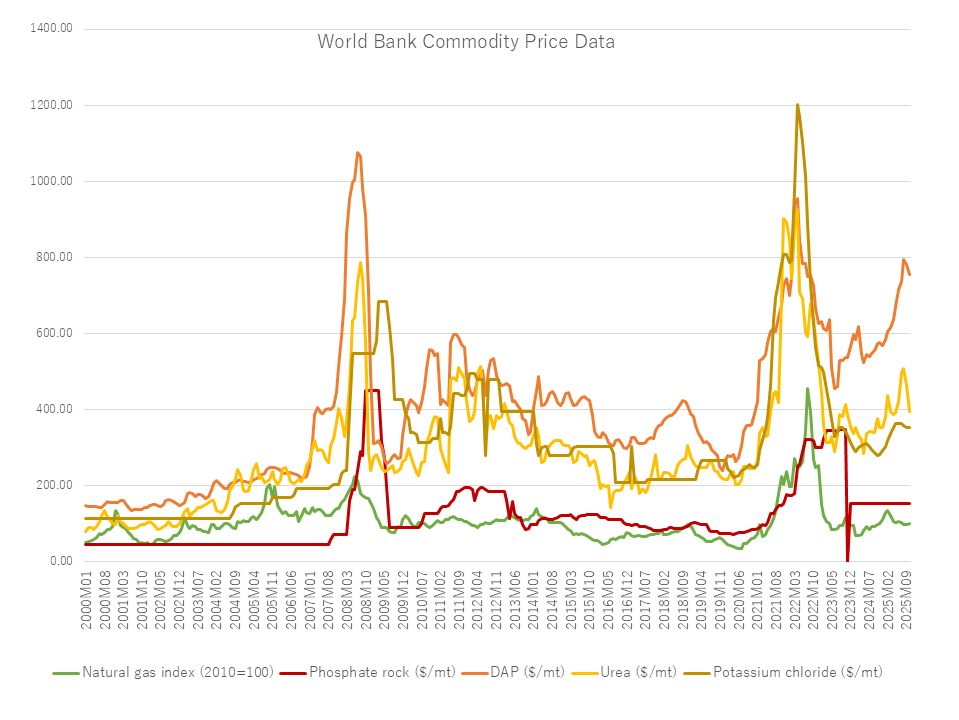

The partial recovery in global fertilizer use in 2024 was primarily due to lower fertilizer prices, which continued through the first half of 2025, after which prices began to rise before softening in August 2025. Because fertilizer use is closely linked to affordability, demand for all three major nutrients showed signs of decline compared to 2024. Overall, nitrogen demand is more robust than phosphorus and potassium, reflecting nitrogen's important role in crop growth and, therefore, yield. Nitrogen demand growth is primarily driven by India, supported by increased urea subsidies and a reduction in the Goods and Services Tax (GST) on agricultural inputs and machinery (from 18% to 5%). This growth is also supported by China, where a renewed emphasis on agricultural self-sufficiency through increased input utilization plays a key role. Meanwhile, as of October 2025, phosphorus demand is recovering but remains weak in East Asia, South Asia, Eastern Europe, and Central Asia. This is because high phosphorus prices are causing farmers to reduce phosphorus use or switch to lower-phosphorus products. The recovery in potash demand is led by Brazil, China, Indonesia, and Malaysia.

The production costs, and therefore the availability, of mineral fertilizers are closely linked to energy prices. Natural gas is a key feedstock for all nitrogen fertilizers, as well as the widely used monoammonium phosphate (MAP) and diammonium phosphate (DAP) fertilizers, and various nitrogen, phosphorus, and potassium (NPK) blends. Stable natural gas prices support predictability in fertilizer production and supply. The average price of the Netherlands Natural Gas Transfer Facility (TTF) index (the main benchmark market for gas trading in Europe) in 2024 was €35/megawatt-hour, down 15% compared to the annual average in 2023. As of 2025, natural gas prices are less volatile than the spikes in late 2021 and throughout 2022. However, price levels increased by 19% from January to October 2025. Despite rising natural gas prices, fertilizer production costs are increasing more slowly in 2025 than at historical peaks. In addition to more muted natural gas price volatility compared to 2022, improved structural resilience in fertilizer production is also contributing, particularly for plants with the option to import natural gas and ammonia from lower-cost regions such as the Near East and North Africa.

As of September 2025, export prices for a fertilizer basket containing nitrogen, phosphorus, and potassium averaged US$489/ton, up 46% from September 2024 but still 40% below the all-time high of US$815/ton reached in April 2022. The impact of higher natural gas prices in 2025 is most pronounced in nitrogen fertilizer prices, which averaged US$359/ton from January to September 2025, up 23% from the same period in 2024.

(Reference)

FAO. 2025. Food Outlook – Biannual report on global food markets. Food Outlook, November 2025. Rome. https://doi.org/10.4060/cd7448en

Contributor: IIYAMA Miyuki, Information Program