Pick Up

1337. Global Temperatures in August 2025 and Global Food and Fertilizer Market Trends

1337. Global Temperatures in August 2025 and Global Food and Fertilizer Market Trends

According to a September 9 announcement by the EU's Copernicus Climate Change Service, August 2025 was the third warmest August on record globally, with the average surface temperature reaching 16.60°C, which is 0.22°C lower than the hottest Augusts on record in 2023 and 2024. The 12-month period from September 2024 to August 2025 was 1.52°C above pre-industrial levels. Globally, temperatures in August 2025 were above normal in Siberia, parts of Antarctica, China, the Korean Peninsula, Japan, and the Middle East, while temperatures were below normal in most of Northern Europe and most of Australia.

According to the World Meteorological Organization (WMO), a La Niña event may occur from September to December 2025, and a negative Indian Ocean Dipole (IOD) event may occur from November 2025 and possibly into December 2025. The latter could result in below-normal rainfall in eastern East Africa and above-normal rainfall in the Indo-Pacific region. The WMO predicts that temperatures will remain above normal in many parts of the world from September onwards, despite the temporary cooling effects of La Niña.

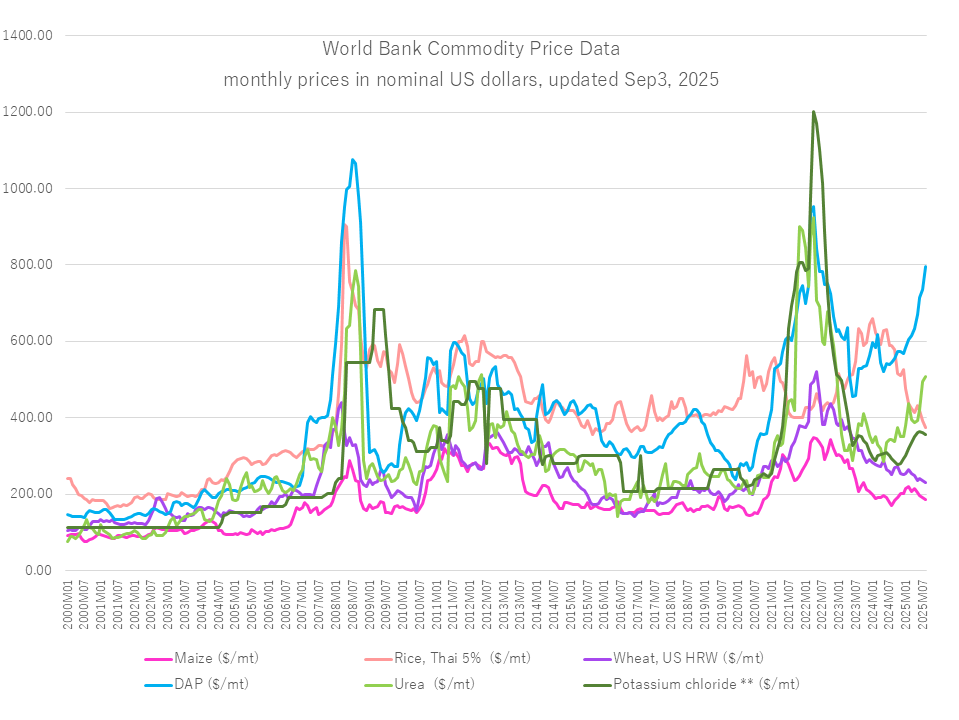

According to the September 2025 report from the Agricultural Market Information System (AMIS), which provides information that contributes to maintaining and enhancing transparency in global food markets, wheat and rice export prices fell to their lowest levels in several years in August, primarily due to a global supply glut and weak demand, while corn and soybean prices were supported by rising export premiums and strong international purchasing interest.

The AMIS report also shows fertilizer price trends. Nitrogen fertilizer prices rose, particularly due to strong demand from India during what is typically the off-season, while phosphorus and potassium fertilizer prices remained roughly flat. However, AMIS noted that in many regions, fertilizer prices are becoming less affordable relative to crop prices, increasing the likelihood that farmers will adjust their application rates. The uncertainties surrounding trade and biofuel policy also remain a risk for market participants.

Contributor: IIYAMA Miyuki, Information Program