Pick Up

1377. World Food Price Trends, October 2025

1377. World Food Price Trends, October 2025

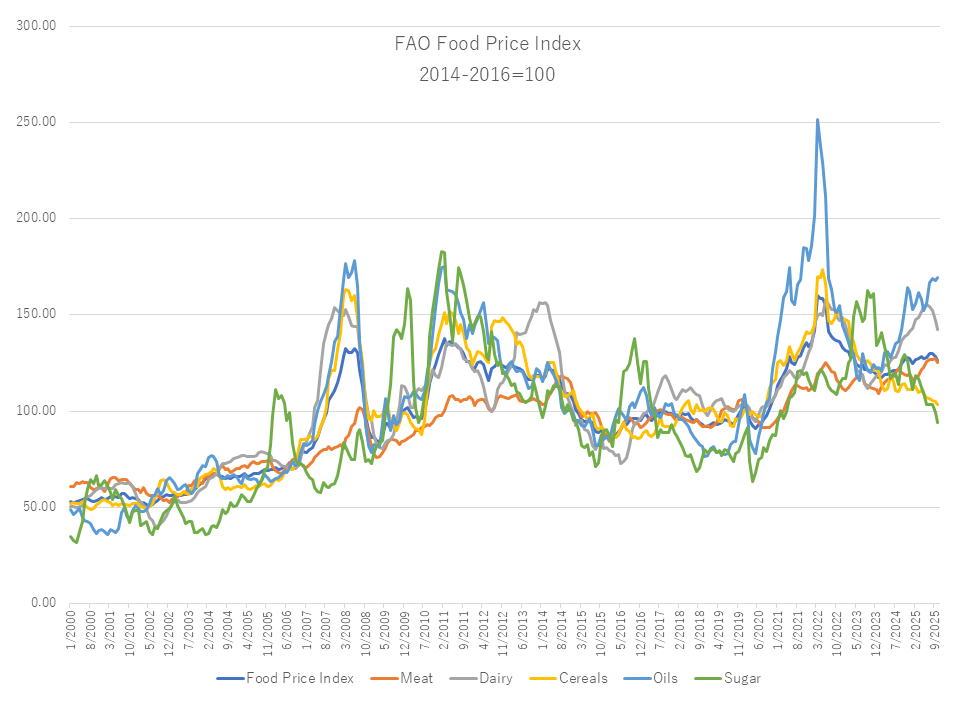

The Food and Agriculture Organization of the United Nations (FAO) released its World Food Price Trends report on November 7. The average for October 2025 was 126.4 points, down 1.6% from the revised September figure of 128.5 points, marking the second consecutive month of decline. Declines in the price indexes for cereals, dairy products, meat, and sugar offset an increase in the vegetable oil index. Overall, the price index remained slightly below its October 2024 level and 21.1% below its peak in March 2022.

The FAO Cereal Price Index fell 1.3% month-on-month and 9.5% year-on-year. All major cereal price indices declined month-on-month. World wheat prices fell 1.0%, reflecting a global supply glut, favorable production prospects in the Southern Hemisphere as harvest season approaches, and steady progress in winter wheat planting across the Northern Hemisphere. Downward pressure on coarse grain prices was partially offset by reports of lower corn harvests in the EU and the United States, and news of a trade agreement between China and the United States. The FAO Rice Price Index fell 2.5% in October 2025, reflecting increased market competition and the start of major crop harvests in several Northern Hemisphere exporting countries.

The FAO Vegetable Oil Price Index averaged 169.4 points, up 0.9% from September, reaching its highest level since July 2022. The increase reflected higher market prices for palm oil, rapeseed oil, soybean oil, and sunflower oil. After declining last month, international palm oil prices, despite Malaysia's higher-than-expected production, reflected expectations of tighter export supplies following Indonesia's planned biodiesel blending mandate in 2026. Sunflower oil prices rose for the fourth consecutive month in October, primarily due to limited supplies from the Black Sea region due to delayed harvests and cautious farm sales, while world rapeseed and soybean oil prices rose due to continued tight supplies in the European Union and increased domestic demand in Brazil and the United States, respectively.

The FAO Meat Price Index averaged 125.0 points in October, down 2.0% from September but up 4.8% year-on-year. After eight consecutive months of increases, the decline was due to sharp declines in pork and chicken prices, as well as lower lamb prices, partially offset by higher beef prices. The Pork Price Index fell amid a global supply glut. Additionally, weaker import demand from China following the implementation of new import tariffs placed further downward pressure on European Union (EU) export prices. The Poultry Price Index also contracted significantly, reflecting lower export prices from Brazil, where China's highly pathogenic avian influenza (HPAI)-related trade restrictions forced exporters to lower-cost destinations. The Lamb Price Index fell due to increased supply, particularly in Australia. Meanwhile, the Beef Price Index continued to rise, driven by stronger prices from Australia on the back of strong global demand.

The FAO Dairy Price Index fell 3.4% from September, marking its fourth consecutive month of declines. Despite this, the index was up 2.7% year-on-year.

The FAO Sugar Price Index averaged 94.1 points in October, down 5.3% from September. This marked the second consecutive month of declines, and the index fell 27.4% year-on-year, reaching its lowest level since December 2020. The decline is largely due to expectations of abundant global sugar supplies. Production in Brazil's main southern sugar-producing region has been strong in recent weeks thanks to favorable weather, and Thailand is also expected to see an increase in production.

Contributor: IIYAMA Miyuki, Information Program