Pick Up

1136. Global Food Price Trends for October 2024

1136. Global Food Price Trends for October 2024

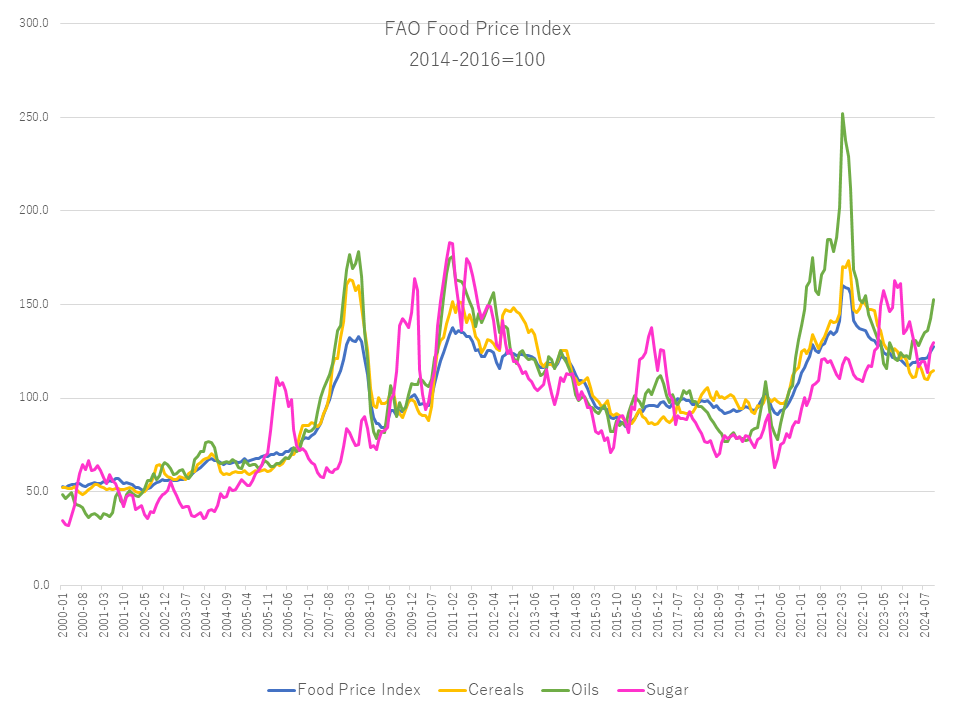

The Food and Agriculture Organization of the United Nations (FAO) released its World Food Price Trends on November 8. The value in October 2024 averaged 127.4 points, up 2% from September and the highest level since April 2023. All commodity price indicators, except for the meat indicator, increased, and the increase in oil prices reached 7.3%. This figure was 5.5% higher than last year, but 20.5% lower than the all-time high in March 2022.

The grain price index rose 0.8% month-on-month to 114 points in October, but was 8.3% lower year-on-year. Global wheat export prices rose for the second month in a row, reflecting concerns about bad weather for winter wheat in major exporting countries, including the EU, Russia, and the United States. In addition, the reintroduction of unofficial price floor controls in Russia and tensions in the Black Sea region put upward pressure on prices. Global maize prices continued their upward trend, reflecting domestic demand in Brazil and concerns about transportation due to lower river water volumes. Water shortages in Argentina and strong demand for Ukrainian maize are also driving price increases. Meanwhile, the rice price index fell 5.6%, reflecting export competition for indica rice following India's withdrawal of export restrictions on non-inferior rice.

Vegetable oil price indicators rose 7.3% month-on-month, reaching a two-year high. The price increase reflected an increase in the palm, soybean, sunflower, and rapeseed price indicators. This is the fifth consecutive month of increases in international palm oil prices following weaker-than-expected production in Southeast Asia, which coincides with seasonal production sources. Soybean prices remained firm amid supply constraints in alternative oil crops, while sunflower and rapeseed prices rose on expectations of tighter supply following the expected production decline in FY2024-25.

Sugar prices rose 2.6% month-over-month in October, but were still 18.6% lower than they were a year ago. The rally in October was driven by concerns about tight supply in 2024-25. In addition to the prospect of a poor harvest in Brazil, this is due to the diversion of sugarcane to ethanol production due to high international oil prices. On the other hand, the depreciation of the Brazilian real against the US dollar and the rainfall in southern Brazil at the end of October served as a deterrent to a sharp rise in global sugar prices.

Contributor: IIYAMA Miyuki, Information Program