Pick Up

892. October 2023 World Food Price Index

892. October 2023 World Food Price Index

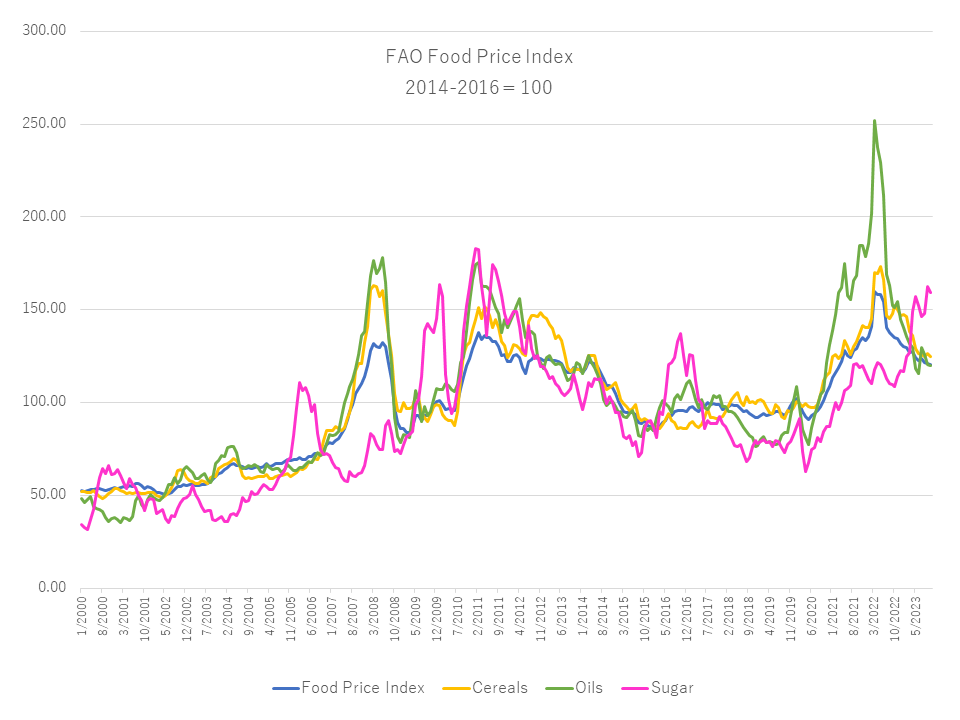

On November 3, the Food and Agriculture Organization of the United Nations (FAO) published its World Food Price Index for October 2023. The index, which averaged 120.6 points, showed a slight decrease of 0.7 points (0.5%) compared to the previous month and a more significant decrease of 14.8 points (10.9%) compared to the same period last year. The decline in the price index in October was due to lower prices in key food categories, including sugar, cereals, edible oils and meat.

In October, the Cereal Price Index registered 125.0 points, a decrease of 1.0% from the previous month and a significant decrease of 17.9% from a year ago. The decrease in cereal prices was primarily driven by a 1.9% decrease in wheat prices, which was the result of higher than expected supplies in North America and competitive dynamics among exporting countries. While tight corn supplies in Argentina initially put upward pressure on prices, competition from North American sources and Brazilian production helped to limit significant price increases. In addition, rice prices fell 2.0% from the previous month, largely due to passive international import demand.

The Vegetable Oil Price Index fell for the third consecutive month, by 0.7% month-on-month and by a significant 20.7% year-on-year. This decline was primarily due to lower palm oil prices, influenced by seasonal supply increases and weak international demand. However, this decrease was offset by comparatively higher prices for soybean, sunflower and rapeseed oils. In particular, soybean oil prices bucked the downward trend and rose for the first time in two months due to robust biodiesel demand in the United States and other regions.

In October, the Sugar Price Index recorded a level of 159.2 points, marking its first decline in two months with a decrease of 2.2% compared to the previous month. This decline was supported by robust sugar production despite the impact of rain damage in Brazil. Nevertheless, international sugar prices remain significantly higher, up 46.6% year-on-year. Contributing factors include the depreciation of the Brazilian real against the US dollar and low domestic ethanol prices. However, concerns about potential global supply shortages in 2023/24, coupled with transportation delays due to logistical constraints in Brazil, have prevented sugar prices from falling further.

Contributor: IIYAMA Miyuki (Information Program)