Pick Up

874. September 2023 World Food Price Index

874. September 2023 World Food Price Index

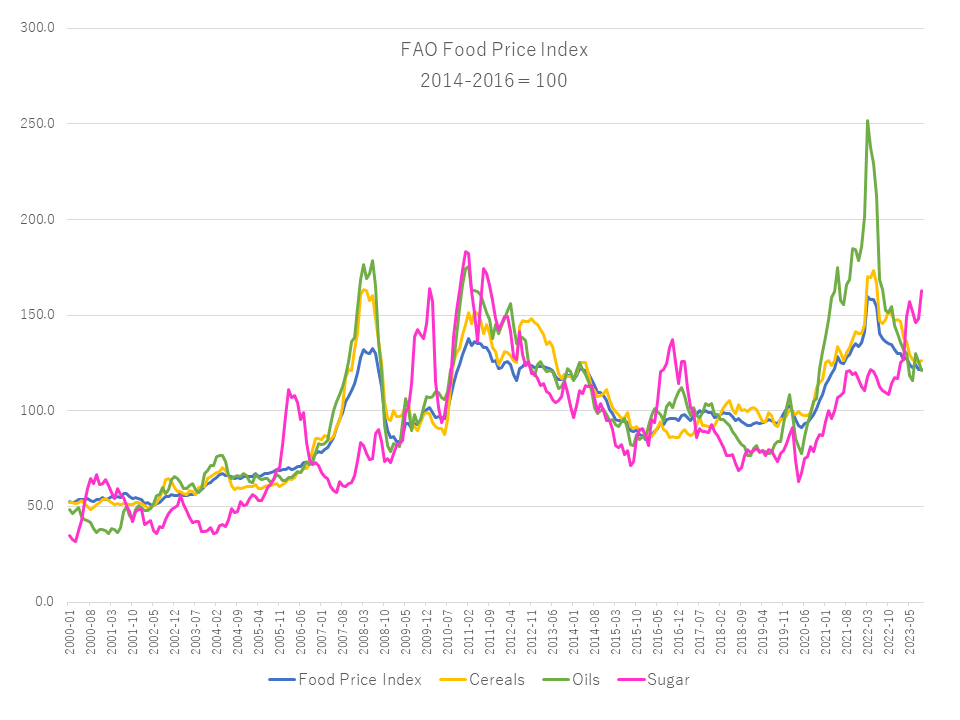

The Food and Agriculture Organization of the United Nations (FAO) released its World Food Price Index on October 6. The index averaged 121.5 points in September 2023, unchanged from the previous month and 21.6 points (14.6%) below its peak in March 2022, as higher sugar and cereal price indicators were offset by lower vegetable oil and meat price indicators.

The Cereal Price Index rose 1.0% month-on-month to 126.3 points in September, but is 14.6% lower year-on-year, as a 7.0% increase in international maize prices, which had previously declined for seven consecutive months, drove the September price increase. The increase in maize prices was due to a combination of factors, including strong demand for Brazilian maize, delayed farm sales in Argentina, and higher transportation costs due to lower water levels on the Mississippi River in the U.S., which pushed international sorghum prices higher in line with corn prices. In contrast, international wheat prices are down 1.6% from the previous month on ample supplies from Russia. International rice prices are 27.8% higher than a year ago, although they declined 0.5% month over month in September on generally weak demand, despite uncertainty over export controls in India and tight supplies ahead of the new rice crop in Asia.

The Vegetable Oil Price Index fell 3.9% from the previous month, reflecting low prices for palm oil, sunflower oil, soybean oil, and rapeseed oil in general.

In September, the sugar price rose 9.8% from the previous month to 162.7 points, the highest since October 2010. This price spike reflects concerns about the prospects of lower supplies in Thailand and India during the 2023/24 season, which have been hit by unfavorable weather conditions caused by the El Niño phenomenon. Higher international crude oil prices also affected sugar prices, but a favorable harvest from Brazil and the depreciation of the Brazilian currency against the U.S. dollar have dampened upward price pressure.

Meanwhile, the situation in the Middle East has become more volatile since the weekend of October 7. Geopolitical conflicts may cause oil and fuel prices to soar. Disturbances in commodity markets may spread to food markets through supply chains and affect global food security, requiring the international community to work together toward peace.

Contributor: IIYAMA Miyuki (Information Program)