Pick Up

1353. World Food Price Trends, September 2025

1335. World Food Price Trends, August 2025

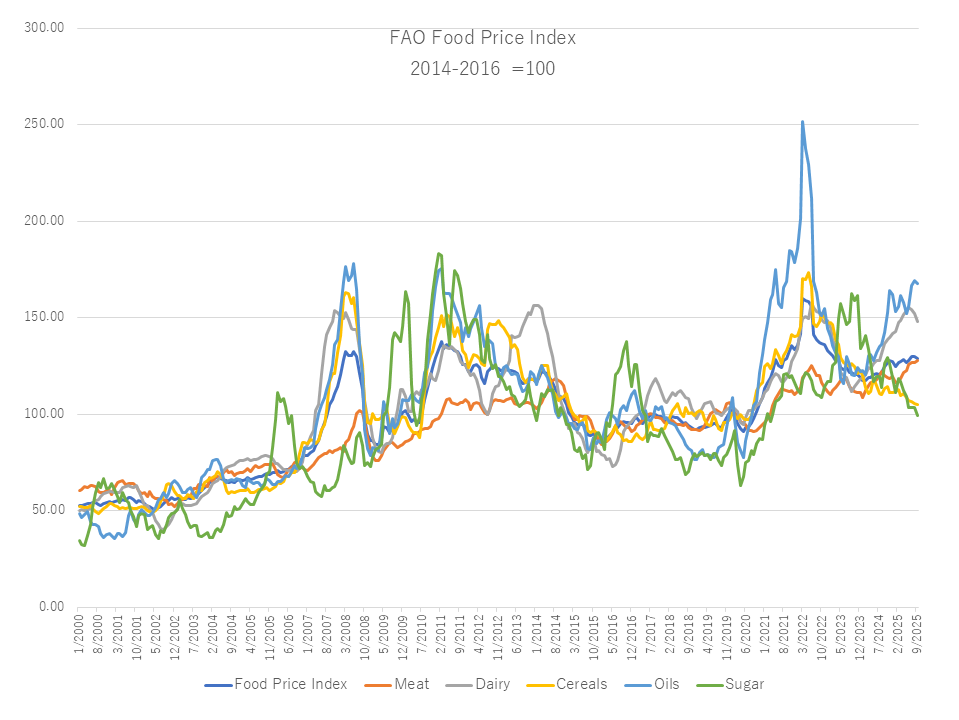

The Food and Agriculture Organization of the United Nations (FAO) released its world food price forecast on October 3rd. The average for September 2025 was 128.8 points, down slightly from the revised August figure of 129.7 points. Declines in the cereal, dairy, sugar, and vegetable oil indices outweighed the increase in the meat index. Overall, the price index was 3.4% higher than in September 2024, but remained 19.6% lower than its peak in March 2022.

The FAO Cereal Price Index was down 0.6% from August and 7.5% from September 2024. World wheat prices fell for the third consecutive month in September, primarily due to weak international demand and confirmation of bumper harvests in the Russian Federation and major producers in Europe and North America. Corn prices also fell on the prospect of oversupply in exporting countries such as Brazil and the United States, while the suspension of grain export taxes in Argentina also weighed on corn prices. Meanwhile, the FAO All Rice Price Index, reflecting an exportable oversupply and reduced orders from buyers in the Philippines and Africa, fell 0.5% in September 2025, primarily due to lower indica rice prices.

The FAO Vegetable Oil Price Index fell 0.7% from August but remained 18.0% above the same month last year. The decline primarily reflected lower palm oil and soybean oil prices, more than offsetting higher sunflower and rapeseed oil prices. International palm oil prices fell slightly, primarily due to higher-than-expected Malaysian inventories in August reaching a 20-month high, offsetting the impact of strong global import demand. Global soybean oil prices fell for the second consecutive month, weighed down by increased supplies from Argentina following the suspension of export taxes on soybeans and soybean-derived products in late September. Meanwhile, sunflower oil and rapeseed oil prices continued to rise, reflecting continued supply tightness in the Black Sea region and Europe, respectively.

The FAO Meat Price Index rose 0.7% from its revised August reading and was 6.6% above the previous year, reaching a new record high. The increase reflected higher global beef and lamb prices, while pork and chicken prices remained broadly stable. Beef prices were supported by strong demand in the United States, while domestic supply constraints and favorable price differentials continued to drive imports, particularly from Australia, where prices rose. Brazilian beef prices also rose, supported by strong global demand, offsetting a decline in U.S. imports due to higher tariffs. Global lamb prices rose sharply as global import demand remained strong amid limited exports from Oceania. Pork prices stabilized as solid alternative market demand for Brazilian pork offset a decline in Chinese purchases. In the European Union, new tariffs imposed by China had limited impact on pork export prices. Poultry prices remained firm, reflecting a relatively balanced global market despite import restrictions related to local outbreaks of highly pathogenic avian influenza.

The FAO Dairy Price Index averaged 148.3 points in September 2025, its third consecutive month of decline and a 2.6% decrease from August, but still nearly 9% higher than the same month last year.

The FAO Sugar Price Index fell 4.1% from August and 21.3% from a year earlier, reaching its lowest level since March 2021. The decline was driven by a stronger-than-expected increase in sugar production in Brazil, particularly due to higher crush volumes and increased cane use for sugar production in the main southern growing region. In India and Thailand, favorable harvest prospects, driven by abundant monsoon rains and expanded planted areas, further pressured prices.

Contributor: IIYAMA Miyuki, Information Program