Pick Up

1395. World Food Price Trends, November 2025

1395. World Food Price Trends, November 2025

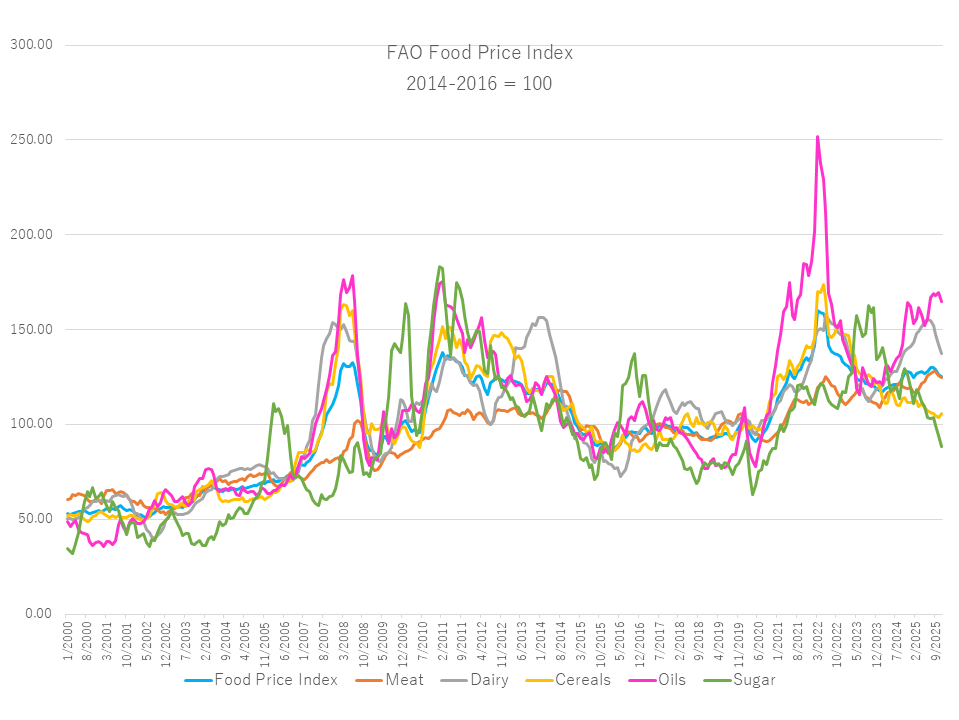

The Food and Agriculture Organization of the United Nations (FAO) released its World Food Price Trends report on December 4. The average for November 2025 was 125.1 points, down 1.2% from the revised October figure of 126.6 points, marking the third consecutive month of declines. Declines in the price indexes for dairy products, meat, sugar, and vegetable oils outweighed the increase in the cereal index. Overall, the price index remained 2.1% below its November 2024 level and 21.9% below its peak in March 2022.

The FAO Cereal Price Index rose 1.8% from October but remained 5.3% lower than the same month last year. Although the supply outlook was generally favorable and there were reports of good harvests in Argentina and Australia, global wheat prices rose 2.5% in November, the highest since the first half of 2020, reflecting potential Chinese interest in supplies from the United States, concerns about continued conflict in the Black Sea region, and expectations of reduced plantings in the Russian Federation. International corn prices also rose in November, supported by strong demand for Brazilian supplies and reports that rains in Argentina and Brazil were disrupting field operations. World prices for barley and sorghum also rose, while higher soybean prices impacted major cereal prices across the board. Meanwhile, the FAO Rice Price Index fell 1.5% in November as weak harvests of major crops in Northern Hemisphere exporting countries and weak import demand put downward pressure on prices of indica and aromatic rice.

The FAO Vegetable Oil Price Index fell 2.6% in November from October to its lowest level in five months. The decline reflected lower prices for palm oil, rapeseed oil, and sunflower oil, more than offsetting a slight increase in soybean oil prices. International palm oil prices fell in November, becoming cheaper relative to competing oils, primarily due to higher-than-expected Malaysian production. Meanwhile, rapeseed oil prices, which had been rising for several consecutive months, fell on a favorable global production outlook, while sunflower oil prices fell on seasonally higher supplies from the Black Sea region. Global soybean oil prices remained stable and rose slightly, supported by strong demand from the biodiesel sector, primarily in Brazil. Falling crude oil prices also contributed to the decline in vegetable oil prices.

The FAO Meat Price Index fell 0.8% from its revised October reading but remained 4.9% higher than the same month last year. Chicken prices fell amid abundant export supplies and intensifying global competition, as major importing countries (including China, which lifted its restrictions in early November) lifted their highly pathogenic avian influenza (HPAI)-related trade bans, leading to efforts to regain market share. Pork prices also fell, primarily due to a decline in prices in the European Union (EU) following the imposition of import tariffs in early September, driven by oversupply and weak demand, particularly from China. Meanwhile, the elimination of beef import tariffs into the United States eased price pressures, particularly on Australian beef, as major exporters sought to maintain their competitiveness, broadly stabilizing global beef prices. Meanwhile, sheepmeat prices rose, supported by solid global import demand.

The FAO Dairy Price Index fell 3.1% month-on-month and 1.7% year-on-year. This continued price decline is driven by increased milk production and ample export supplies in key producing regions, supported by ample butter and skim milk powder stockpiles in the European Union and seasonally higher production in New Zealand. Weak demand for milk powder imports in parts of Asia also weighed on prices.

The FAO Sugar Price Index fell 5.9% from October and 29.9% from a year earlier, marking the third consecutive month of declines and the second consecutive month of its lowest level since December 2020. Expectations of abundant global sugar supplies this season continue to put downward pressure on prices. In Brazil's key southern growing region, sugar production remained strong despite a seasonal slowdown in cane crushing, reducing cane use in sugar production. A strong start to India's 2025/26 harvest and favorable crop prospects in Thailand further strengthened the global sugar supply outlook, increasing downward pressure on prices.