Pick Up

1063. Fertilizer Price Trends

1063. Fertilizer Price Trends

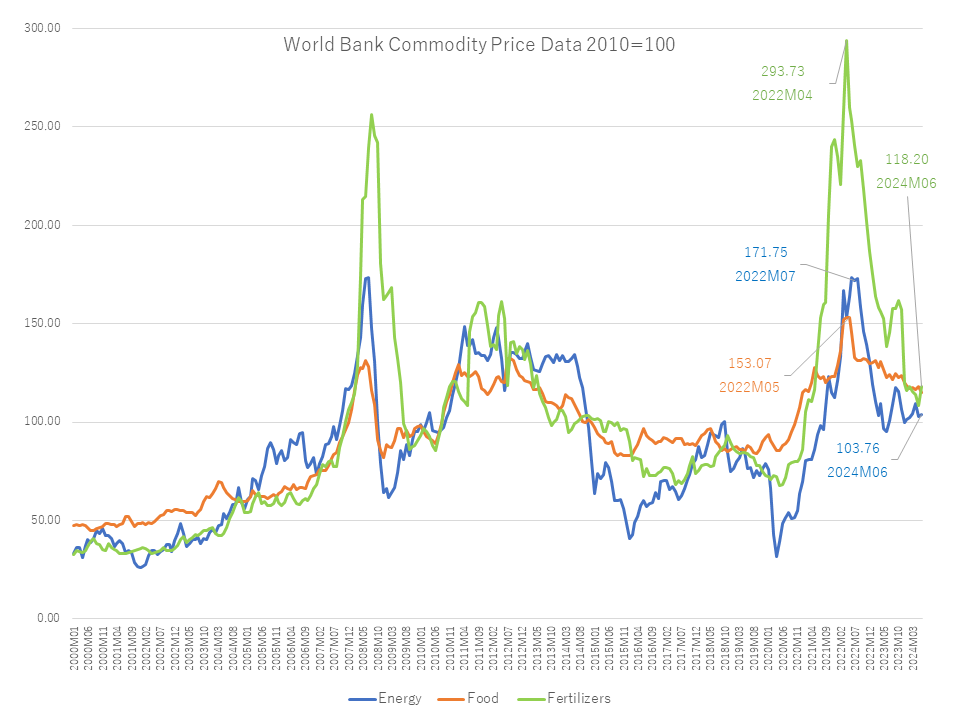

Both chemical and organic fertilizers are widely used in agriculture and are essential to global food security. However, the distribution of chemical fertilizers such as nitrogen, phosphorus, and potassium is constantly exposed to the risk of supply chain disruption due to economic, environmental, and geopolitical reasons. In fact, from 2021 to 2022, fertilizer prices skyrocketed, pushing global food prices to all-time highs. By 2023, fertilizer prices have stabilized due to lower energy prices and improved supply conditions, and demand and trade have also rebounded. The outlook for 2024–25 is also stable, but shocks to energy markets could be a risk factor.

Today’s blog presents an analysis of chemical fertilizer price trends from FAO's Food Outlook.

Since 2021, fertilizer production, distribution, and trade have been exposed to multiple economic, environmental, and geopolitical risks, and have been at the mercy of market trends, especially for fuels used as feedstocks for nitrogen fertilizers. The soaring cost of fuel and fertilizer due to Russia's invasion of Ukraine, accompanied by structural changes in the fertilizer market, has led to the closure of several fertilizer plants in Europe and a decline in fertilizer use in several regions.

At one point, the prices of ammonia, urea, and DAP (phosphate fertilizer) exceeded $1,000 per tonne, more than three times the average value for the past 10 years. Some governments have taken trade control measures such as export restrictions and import tariffs due to supply chain disruptions, and the fertilizer import capacity of low- and middle-income countries has been severely limited from 2021–23 amid a credit crunch due to high interest rates. In addition, the cost of transporting chemical fertilizers has also jumped, with the average cost of transportation per tonne reaching $25–50 globally and $70 in Sub-Saharan Africa in 2022.

In 2023, nitrogen fertilizer production increased, mainly due to increased production in China, India, and Russia; phosphorus fertilizer production increased due to production in the Middle East and East Asia outpacing production decreases in Africa such as Morocco; and potassium fertilizer production increased in Laos in addition to Russia and Belarus.

On the demand side, in 2023, the EU, Brazil, and Turkey increased their urea imports, while India, which increased its domestic production system, significantly reduced imports. With regard to phosphorus, the United States, the EU, and Brazil have increased imports of phosphate fertilizers in response to the decline in prices, while India has also reduced imports due to a reduction in subsidy support for farmers. In terms of potassium, China and Brazil significantly increased their imports.

The recent decline in energy prices has been accompanied by a recovery in demand and trade volumes through increased fertilizer production and lower prices. Fertilizer prices (nitrogen, phosphorus, and potassium prices combined) have settled down at $327 in April 2024, up from an average of $815 per tonne in April 2022.

The short-term outlook for the fertilizer market over the next six months is expected to be stable in terms of both volume and price. However, geopolitical and meteorological risks, combined with macroeconomic policies and trade restrictions, could lead to a short-term spike in fertilizer prices, and we need to keep a close eye on energy market developments.

Focusing on specific fertilizers, Russia's new ammonia export terminal in the Black Sea is expected to be operational in late 2024. The distribution network for 1 million tonnes of ammonia, which was previously exported via pipelines in Ukraine, will be restored, and the supply of raw materials for nitrogen and phosphorus production is expected to be stabilized.

Reference

FAO. 2024. Food Outlook – Biannual report on global food markets. Food Outlook, June 2024. Rome. https://openknowledge.fao.org/handle/20.500.14283/cd1158en

Contributor: IIYAMA Miyuki, Information Program