Pick Up

1434. January 2026 World Food Price Trends

1434. January 2026 World Food Price Trends

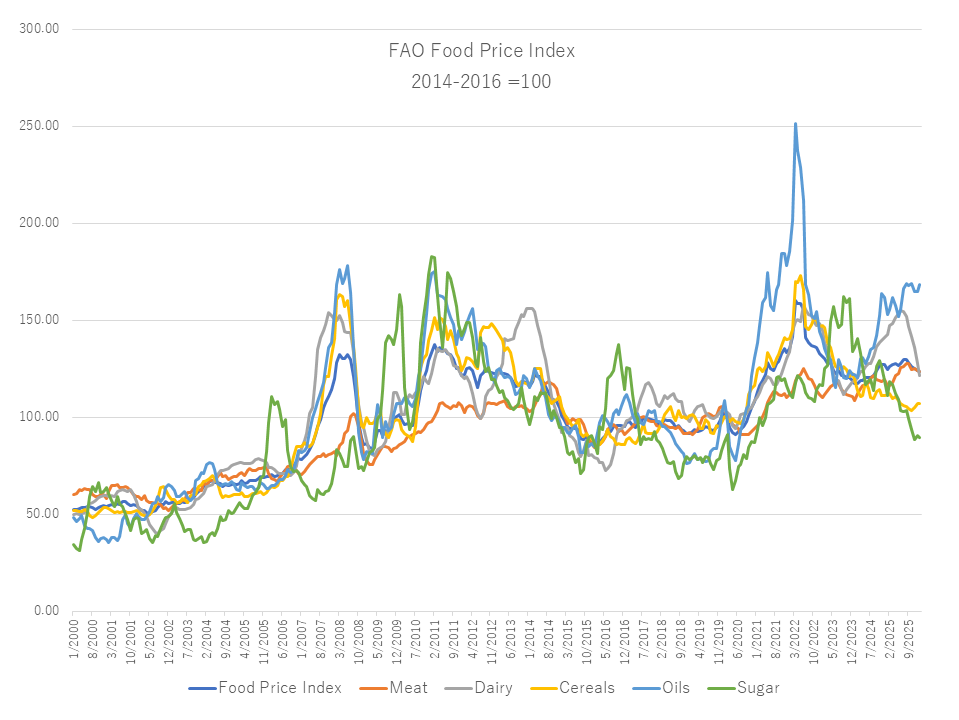

The Food and Agriculture Organization of the United Nations (FAO) released its world food price trend report on February 6th. The average for January 2026 was 123.9 points, down 0.4% from the previous month. Declines in the dairy, meat, and sugar price indexes outweighed increases in the cereal and vegetable oil price indexes, marking their fifth consecutive month of declines. The food index fell 0.6% year-on-year and was 22.7% below its peak in March 2022.

The FAO Cereal Price Index averaged 107.5 points in January, a slight increase of 0.2% month-on-month but a 3.9% decrease year-on-year. Global wheat prices remained essentially stable in January, with upward price pressure from weather concerns affecting dormant crops in the Russian Federation and the United States offset by generally favorable global supply conditions. International corn prices also fell 0.2% from December, as weather-related concerns about planting conditions in Argentina and Brazil, combined with strong ethanol demand in the United States, provided some support but were not enough to offset the generally bearish market sentiment due to the global supply glut. Meanwhile, the FAO Rice Price Index rose 1.8% in January 2026, reflecting strong demand for aromatic rice in particular.

The FAO Vegetable Oil Price Index averaged 168.6 points in January, up 2.1% from the previous month and 10.2% from the same month last year. This increase reflected rising world prices for palm oil, soybean oil, and sunflower oil, which more than offset the decline in market prices for rapeseed oil. International palm oil prices rose for the second consecutive month, driven by a seasonal slowdown in production in Southeast Asia and strong global import demand due to improved price competitiveness. Meanwhile, world soybean oil prices rebounded on tighter export supply in South America and expectations of strong demand from the biofuel sector in the United States. After two consecutive months of declines in the second half of 2025, world sunflower oil prices recovered due to continued supply constraints in the Black Sea region, where farm sales remained limited. Meanwhile, rapeseed oil prices fell slightly, reflecting ample supplies in the European Union (EU) following recent heavy imports.

The FAO Meat Price Index averaged 123.8 points in January, down 0.4% from December but still 6.1% higher than the same month last year. The decline primarily reflected lower international pork prices, while global chicken prices rose. Pork prices fell primarily due to weaker prices in the European Union (EU) amid ample supply, following the elimination of oversupply following temporary slaughterhouse closures over the year-end holidays, despite weak international demand. Chicken prices, on the other hand, rose, reflecting higher prices in Brazil, supported by strong international demand.

The FAO Dairy Price Index averaged 121.8 points in January, down 5.0% from December and down 14.9% from the same month last year. This marks the seventh consecutive month of declines for the index, primarily due to lower global cheese and butter prices offsetting a slight increase in milk powder prices.

The FAO Sugar Price Index averaged 89.8 points in January, down 1.0% from the previous month and 19.2% from a year earlier. The decline was primarily due to expectations of increased global sugar supplies this season, driven by the prospect of a significant production recovery in India and a favorable outlook for Thailand. Additionally, despite a decrease in the share of cane devoted to sugar production, the generally favorable production outlook for Brazil for the 2025/26 season also boosted the global supply outlook, increasing downward pressure on world sugar prices.

Contributor: IIYAMA Miyuki, Information Program