Pick Up

1194.World Food Price Index for January 2025

1194.World Food Price Index for January 2025

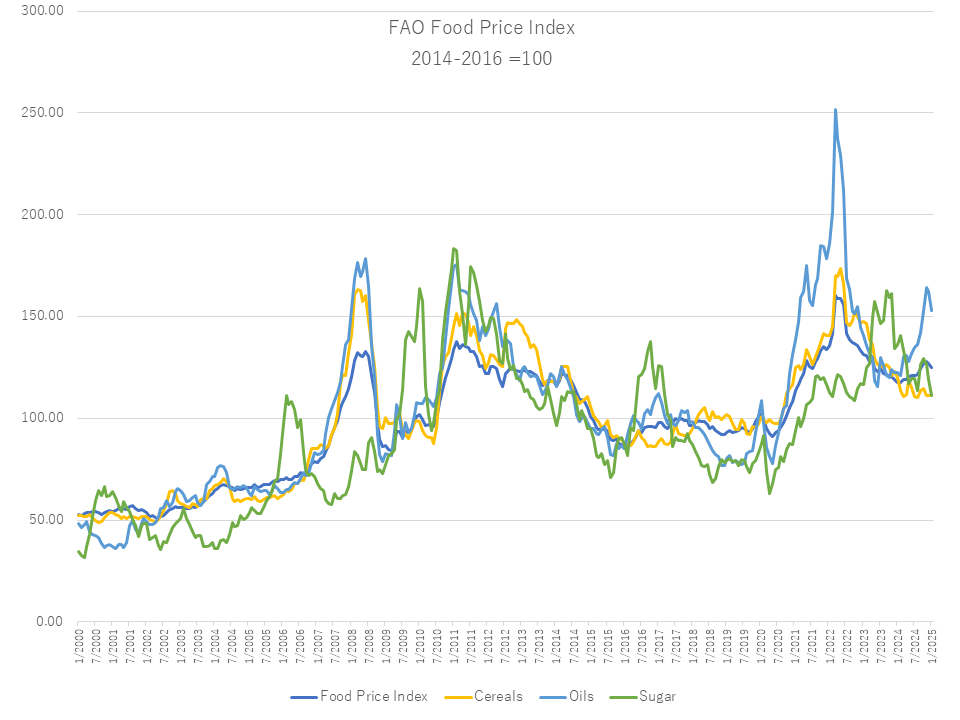

The Food and Agriculture Organization of the United Nations (FAO) announced the world food price index for January 2025 on February 7. The value averaged 124.9 points, down 1.6% from December, and the decline in the price indices for sugar, vegetable oil, and meat exceeded the increase in the price indices for dairy products and cereals. This figure was 6.2% higher than last year but 22.0% lower than the all-time high in March 2022.

The Cereal Price Index was at 111.7 points in January, up 0.3% from the previous month but 6.9% lower than the previous year. World wheat export prices declined slightly and were little changed during the month. Weak import demand led to weak sales from several major exporting countries, weighing on prices, while supply shortages in the Russian Federation and winter crop conditions in parts of the European Union supported prices. Maize prices rose above last year's levels for the first time in two years. Upward price pressures reflected seasonal supply shortages, poor conditions in Argentina at the end of planting, delayed growth in Brazil, and downward revisions to production and inventory forecasts in the United States. Meanwhile, the rice price index fell 4.7%, as abundant export supplies and competition among exporting countries put downward pressure on prices.

The Vegetable Oil Price Index fell 5.6% month-on-month but remained 24.9% higher year-on-year. The month's decline was mainly due to lower global palm oil and rapeseed oil prices, while soybean oil and sunflower oil prices remained stable. After seven consecutive months of increases, international palm oil prices fell from multi-year highs due to demand rationing, while rapeseed oil prices fell moderately in early 2025. In contrast, soybean oil and sunflower oil prices remained stable, supported by concerns about poor weather in some South American soybean-producing countries and firm global import demand, respectively.

The Sugar Price Index fell by 6.8% month-on-month and was down 18.5% year-on-year to reach its lowest level since October 2022. The decline in January was mainly due to generally favorable weather conditions in Brazil in recent months, improving the global supply outlook for the cane harvest starting in April 2025, as well as the ongoing 2024/25 season. Additionally, the Indian government's decision to resume sugar exports, which had been restricted since October 2023, exerted further downward pressure on global sugar prices.

Contributor: IIYAMA Miyuki, Information Program