Pick Up

1211. World Food Price Index for February 2025

1211. World Food Price Index for February 2025

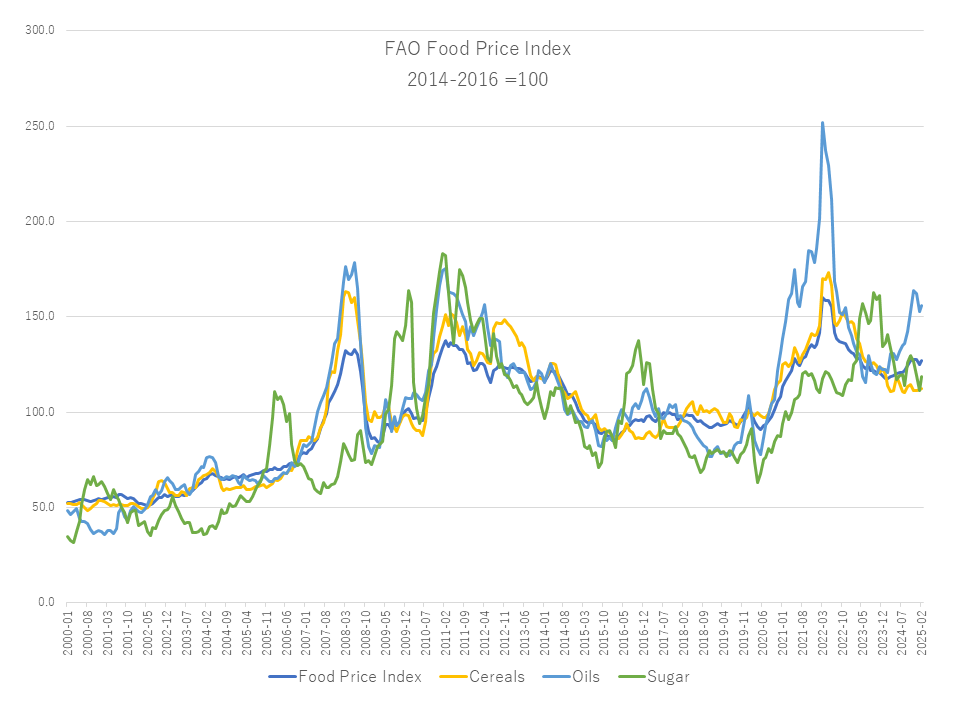

The Food and Agriculture Organization of the United Nations (FAO) released the World Food Price Trends on March 7. The value for February 2025 averaged 127.1 points, up 1.6% from January. While the meat price index was stable, all other price indexes increased, with the most notable increases being for sugar, dairy products and vegetable oils. The overall index was 8.2% higher than the same level a year ago, but 20.7% lower than its peak in March 2022.

The FAO Cereals Price Index averaged 112.6 points in February, up 0.7% from January but remaining 1.1% lower than its February 2024 level. Wheat export prices increased from the previous month due to tighter domestic supplies in the Russian Federation, but export volumes were suppressed and demand shifted to other supplying countries, putting upward pressure on world prices. Further boosting the price increase were concerns over unfavorable crop conditions in parts of Europe, the Russian Federation and the United States. World corn prices continued their upward trend in February, driven by tight seasonal supplies in Brazil, deteriorating crop conditions in Argentina, and strong export demand for U.S. corn. Among other coarse grains, world prices for barley and sorghum also increased. In contrast, the FAO rice price index fell 6.8% in February as abundant exportable supplies and weak import demand put downward pressure on prices.

The FAO vegetable oil price index rose 2.0% month-on-month and 29.1% year-on-year. The increase in the index was driven by higher prices for palm oil, rapeseed oil, soybean oil, and sunflower oil. After a brief decline in January, international palm oil prices recovered slowly and maintained a premium over competing oils. The increase was supported by seasonal production declines, mainly in Southeast Asian producing countries, and expectations of increased demand from Indonesia's biodiesel industry. Meanwhile, world soybean oil prices rose due to solid global demand, especially from the food sector. For sunflower and rapeseed oils, prices were mainly supported by concerns about possible tightness in supplies in the coming months.

The FAO Sugar Price Index rose 6.6% from January after three consecutive months of declines until the previous month, but remained 15.8% below the level in February last year. The rise in world sugar prices was driven by concerns about global supply tightness in the 2024/25 season. Lower production prospects for India and concerns about the impact of recent dry weather, which exacerbated seasonal effects, on Brazil's upcoming crop supported the price increase. In addition, the appreciation of the Brazilian real against the US dollar, which tends to affect exports from Brazil, further contributed to the overall increase in world sugar prices.

Contributor: IIYAMA Miyuki, Information Program