Pick Up

803. June 2023 Food Outlook

803. June 2023 Food Outlook

The FAO Food Outlook, a biannual report on global food markets released on June 15, projects sufficient reserves for many food commodities even with small increases or decreases in production, but notes that the global food system faces extreme weather events, geopolitical tensions and delicate supply and demand balances, and that policy changes and developments in other markets could lead to food price spikes and a global food security crisis. The report also notes that the global food system is facing extreme weather events, geopolitical tensions, and delicate supply-demand balances, and that policy changes and developments in other markets could lead to food price spikes and a global food security crisis.

According to the report, global food imports are expected to reach an all-time high of $1.98 trillion in 2023, an increase of 1.5% from the previous year. However, import growth will slow from 11% in 2022 and 18% in 2021, as rising global food prices curb food demand in vulnerable countries.

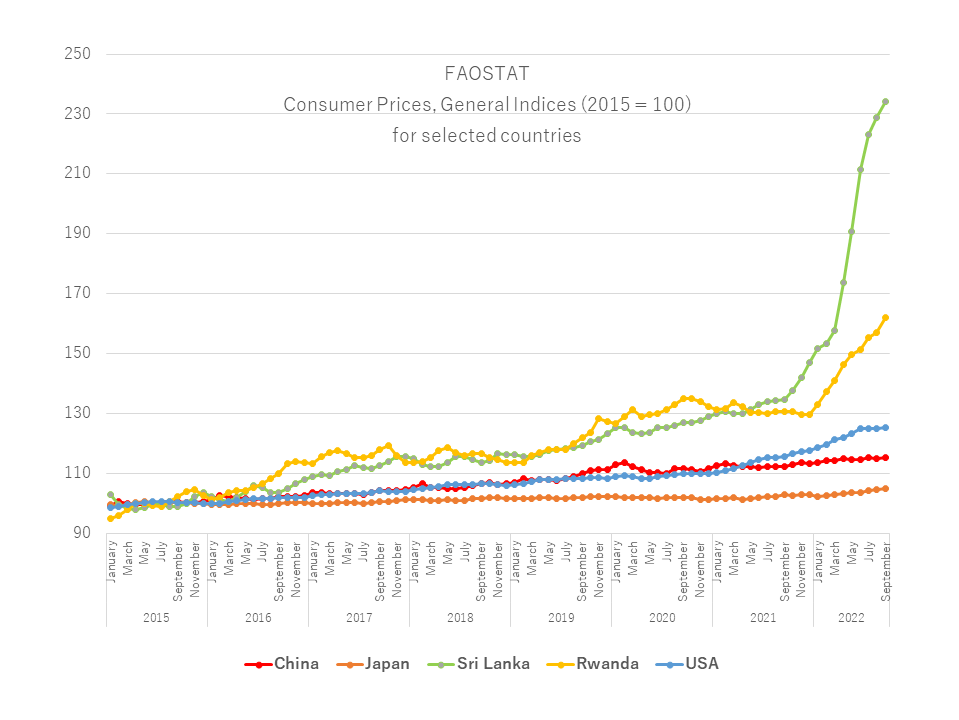

Since early 2021, the Consumer Price Index (CPI), used as an inflation indicator, has been at levels not seen in decades. The recent rise in inflation can be attributed to three main factors: higher commodity prices, supply chain disruptions, and aggressive fiscal stimulus to boost demand in response to the economic slowdown caused by the COVID-19 pandemic. There is concern that inflation could lead to social unrest beyond the long-term macroeconomic consequences.

The report focuses on the extent to which the rise in international cereal prices has affected domestic prices in net food-importing developing countries, in response to exchange rate developments and other factors. In developing countries, the decline in international prices of many food commodities has not been reflected in declines in domestic retail prices, and this continues to put upward pressure on the cost of living in 2023. While during the 2007-2008 global food price crisis, the decline in the value of the U.S. dollar partially offset food price increases for food-importing countries, the opposite trend has been observed in recent years. For example, from April to September 2022, global maize prices fell by 10.2 percent, but real prices in local currency for net food-importing developing countries fell by only 4.8 percent. The report points to the need for meaningful interventions to address food inflation in order to avert social unrest and food security crises.

Reference

FAO. 2023. Food Outlook – Biannual report on global food markets. Food Outlook, June 2023. Rome.

https://www.fao.org/documents/card/en/c/cc3020en

Contributor: IIYAMA Miyuki (Information Program)