Pick Up

17. New Coronavirus Pandemic ― Outlook on Oil Demand and Renewable Energy

Rapidly declining cost of solar and wind power generation has caused the acceleration of the transition to renewable energy globally, especially in the power sector. Accordingly, the renewable energy sector accounted for 72% of the total capacity of additional power generation in 2019 with its share of the total installed capacity reaching 34.7% (IRENA press release dated April 6, 2020). However, the global movement restrictions due to the new coronavirus disease (COVID-19) combined with slowdowns of economic activities due to disruptions in the supply chain and closure of related equipment factories, have casted a shadow on the growth outlook for 2020.

In particular, the decline in oil demand and the drop in crude oil prices due to restrictions on movement and travel, and weak economic activities are significant. According to the Oil Market Report released by the International Energy Agency (IEA) on April 15, oil demand in April is estimated to be 29 million barrels a day lower than a year ago, down to a level last seen in 1995. Twin demand and supply shocks caused oil futures prices to fall by 40% in March (Oil Market Report – April 2020, IEA).

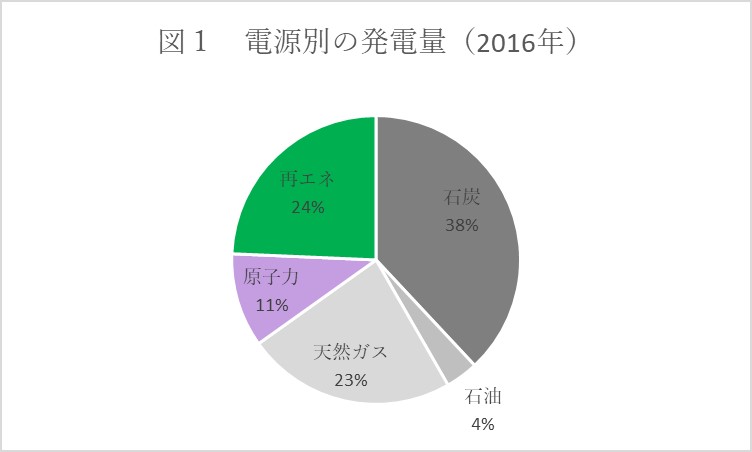

While some argue that the decline in crude oil prices may restrain investments in renewable energy, the International Renewable Energy Agency (IRENA) articulates that oil plays a negligible role in power generation accounting for only 4% of the total power generation (Fig. 1) making the impact of falling oil prices on renewables less significant, and rather oil price volatility may increase the uncertainty of investment providing a window of opportunity to reduce or redirect fossil fuel subsidies towards clean energy (IRENA press release).

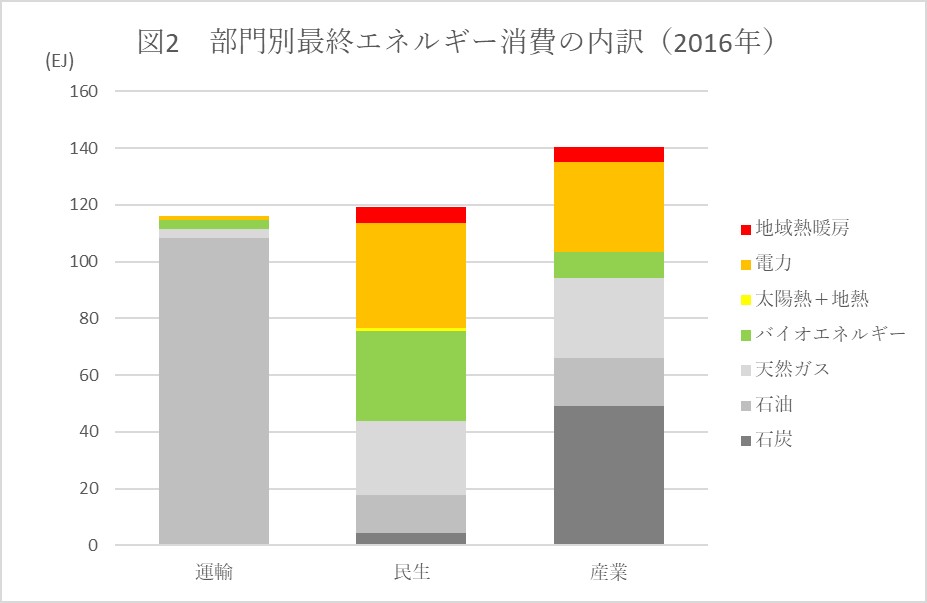

On the other hand, biofuels market for the transportation sector has been profoundly affected in the short term by the oil price shock and the sharp drop of oil demand. While the transport sector heavily relies on oil for its energy demand exceeding 90% of total consumption (Fig. 2), as many as 70 countries have put in place biofuels blending policies to decarbonize the road transport. As such bioethanol and biodiesel are used by blending with petroleum fuels such as gasoline and fossil diesel, making them vulnerable to sluggish oil market. A number of biofuel refining plants have been reported to be shut down or remain idle while some bioethanol refineries have adapted by switching the production to cater for hand sanitizer alcohol to maintain the plant operation. In Brazil where flex fuel vehicles (vehicles designed to run at any blending ratio) predominates the sales of new vehicles totaling more than 90% and sugarcane juice can be flexibly converted to either sugar or bioethanol production routes depending on the market conditions, the consumption of bioethanol has reached about 50% of the total fuel consumption for automobiles , the shift from ethanol to sugar is taking place since the effects of the coronavirus became apparent (Nasdaq March 23, 2020).

Another sector under direct impact of the current crisis is the aviation. Given that the aviation contributes with more than 5% of the total emissions, the International Civil Aviation Organization (ICAO) agreed in 2016 on the global aspirational goal of carbon-neutral growth from 2020 onwards with the 2019/2020 emissions used as baseline, and the introduction of the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) that requires airlines to compensate for their growth in their CO2 emissions above the baseline levels beyond 2021. While airline companies have been gradually making inroads into the uptake of biojet, the effective implementation of CORSIA is also a pressing issue in light of the increasing trend of demand for aviation. In this respect, the decision by the Council of ICAO in March this year to approve six programmes as eligible for delivering carbon credits to airlines will form the foundation for the implementation of CORSIA. Grounded airplanes in 2020 due to a sharp decline in demand resulting from the restriction on the movement of people means fewer emissions from the sector, lowering the 2019-2020 baseline beyond which airlines need to compensate for their emissions from 2021 onward. If international aviation emissions were to rebound in the future back to the emission levels that had been estimated before the crisis, airlines would have to make more credit purchases through CORSIA than expected (BLOG April 7, 2020). The focus of the discussion is on bailout measures for airlines that have had a major impact on management for now, but the decarbonization pathways that have already been agreed by the aviation sector must continue to be explored.

Any government in consideration of economic stimulus packages and relief measures should be mindful that the need for accelerating energy transformation, a key component of the long-term goals for the climate safe future remain unchanged ever after the coronavirus crisis. Rather, it is now necessary to pave the way toward the decarbonization of socioeconomic systems and thereby achieving Sustainable Development Goals (IRENA March 14, 2020).

JIRCAS in collaboration with the IRENA Innovative and Technology Center (IITC, Germany) has been analyzing latest trend of bioenergy market to facilitate the promotion of technical development in developing countries through information sharing and exchange of best practices.

References

BLOG. Changes in course needed for UN scheme to address aviation emissions. April 7, 2020.

IRENA. IRENA Director-General Statement on Oil Prices and Impact on the Renewable Energy Sector. March 14, 2020.

Nasdaq. Falling fuel prices, weak currency drive Brazil switch from ethanol to sugar. Reuters. March 23, 2020.

Contributor: MASUYAMA Toshimasa (Research Strategy Office)