Pick Up

943. Recent Food Prices and the State of the Food Supply Chain

943. Recent Food Prices and the State of the Food Supply Chain

According to the World Bank's January 22 Food Security Update blog, many countries continue to struggle with high domestic food prices. In particular, 63.2% of low-income countries, 73.9% of lower-middle-income countries, 48% of upper-middle-income countries, and 46.3% of upper-middle-income countries are experiencing inflation rates of 5% or more. In addition, food price inflation is significantly higher than overall inflation in 73% of the 165 countries for which data are available.

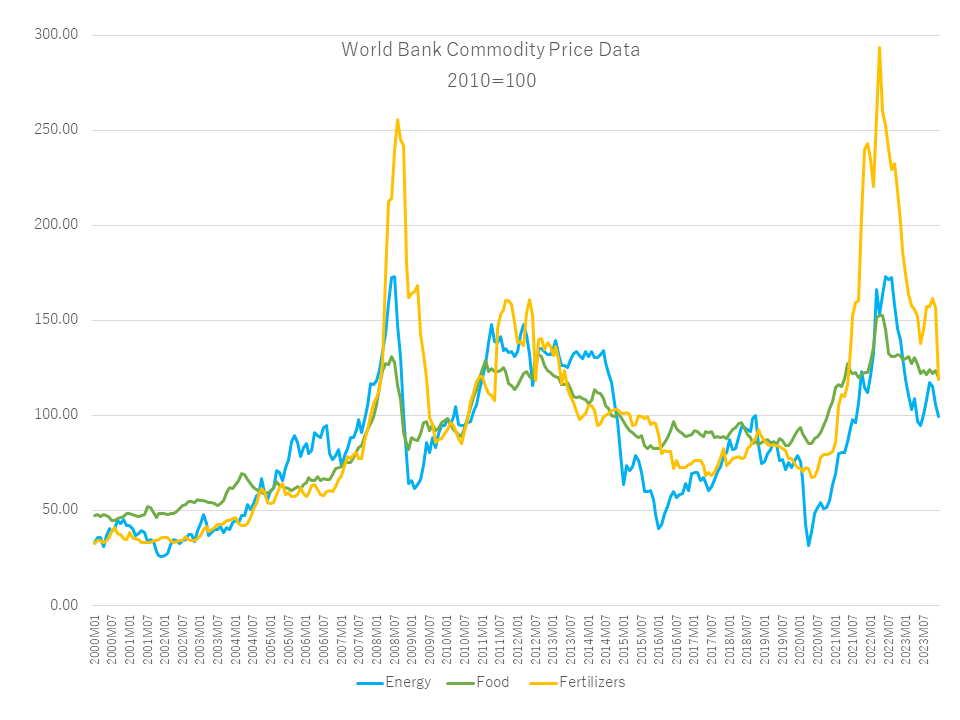

The blog highlights the looming risk that escalating conflict in the Middle East will lead to higher oil prices, which in turn will affect the production and transportation costs of food and fertilizer. Several factors pose potential disruptions to food supplies, including the impact of the 2023/24 El Niño on tropical crop prices, India's restrictions on rice exports (excluding basmati rice), Russia's withdrawal from the Black Sea Grains Initiative, deteriorating macroeconomic conditions and exchange rate volatility due to rising interest rates, and the ongoing effects of climate change. The blog highlights a wide range of uncertainties. It also points to an increasing trend of trade-related restrictions by exporting countries, particularly in the wake of Russia's invasion of Ukraine. As of January 17, 2024, 15 countries have imposed 21 food export bans, while 11 countries have imposed 14 export restrictions. This complex landscape adds to the challenges of global food security.

A January 17 blog from the International Food Policy Research Institute (IFPRI) examines the impact of the escalating security situation in the Middle East on the global food supply chain. Raids by Yemeni Houthi groups on Red Sea shipping have disrupted traffic through the Suez Canal, forcing exporters from the Black Sea and beyond to consider alternative routes at significantly higher costs.

Following the crackdown, trade volumes through the Red Sea have reportedly plummeted by 40%. Based on historical data for 2018-2020, 14% of global grain trade and 4.5% of soybean trade passes through the Suez Canal. Countries in East Africa, South Asia, Southeast Asia, and East Asia rely heavily on food imports via the Red Sea. A prolonged disruption in the supply chain could lead to increased costs for consumers in the importing countries, possibly prompting them to seek alternative suppliers.

In particular, East African countries are heavily dependent on food imports via the Suez Canal. For example, the shortest route to the port of Mombasa in Kenya for wheat shipments from the EU, Russia and Ukraine is through the Suez Canal, while the route via the Cape of Good Hope is more than twice as long. Challenges to the Red Sea route may force Kenyan importers to divert imports to Australia and Argentina. The ongoing impact of Russia's invasion of Ukraine on wheat exports to sub-Saharan Africa and South Asia is expected to intensify as the shift away from Ukraine accelerates. In addition, China, a recent importer of Ukrainian corn, may seek alternative sources if transportation costs increase.

The blog concludes that while the Red Sea crisis has not yet reached a worst-case scenario, the current disruptions underscore the vulnerability of the supply chain. Importing countries are now urged to proactively diversify their food sourcing sources, recognizing the need for flexibility in the face of potential supply disruption crises.

Contributor: IIYAMA Miyuki (Information Program)