Pick Up

872. Uncertainties in the Global Rice Market

872. Uncertainties in the Global Rice Market

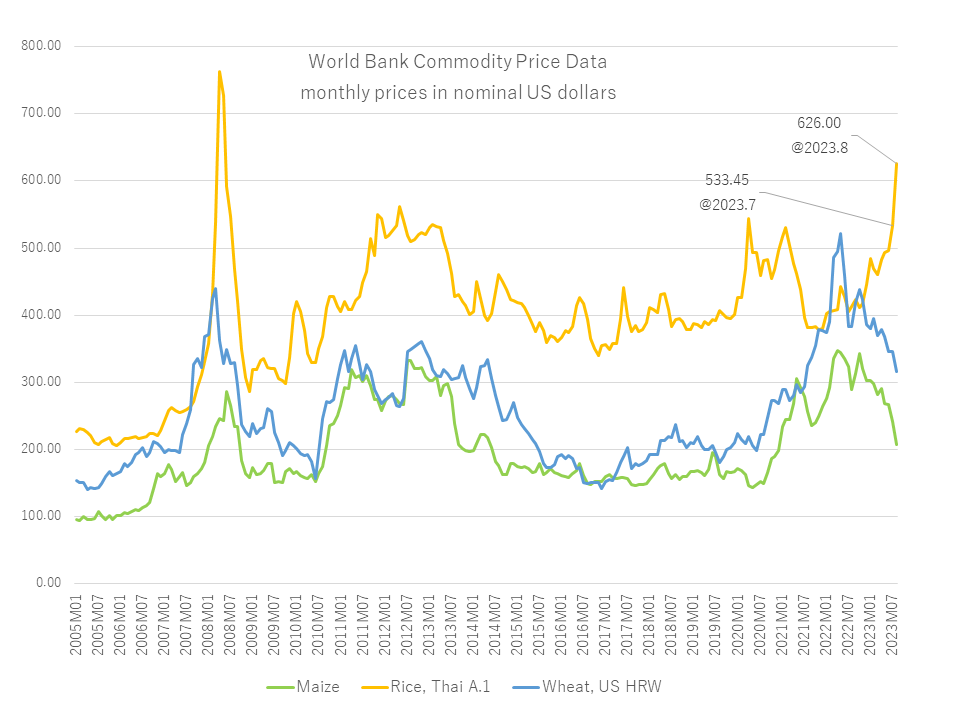

On July 20, the Indian government imposed a ban on the export of rice varieties other than Basmati in an attempt to stabilize domestic prices, raising concerns about a potential spike in global rice prices. Adding to these concerns, adverse weather patterns caused by the El Niño phenomenon have created uncertainty about rice production and subsequent price trends.

Recently, on October 2, the International Food Policy Research Institute (IFPRI) provided insights into the dynamics of the global rice market.

As outlined in the blog post, following India's export ban on non-Basmati rice at the end of July, rice prices in Thailand increased by 14%, Vietnamese rice prices increased by 22%, and white rice prices in India increased by 12%.

On September 1, the Philippines responded to rising retail rice prices by implementing measures to mitigate the increase. Fearing the economic impact of escalating rice prices, an ASEAN meeting in August declared a collective commitment to ensure unimpeded trade in agricultural products.

Of the 15 countries importing significant quantities of non-Basmati rice from India in 2022, nine are in sub-Saharan Africa (Madagascar, Benin, Angola, Kenya, Ivory Coast, Cameroon, Mozambique, Togo, and Guinea). Many of these countries are both major rice producers and net importers, relying on rice imports to supplement their important staple crops. If forced to source rice from higher-priced sources such as Thailand, Vietnam, Pakistan, Myanmar, and the United States instead of India, these countries could face a looming food security crisis. India's non-Basmati rice exports also extend to other Asian countries such as Nepal, Vietnam, Malaysia, the United Arab Emirates, and Sri Lanka.

During the 2007-08 food crisis, export restrictions imposed by major rice-exporting countries, including Thailand, Vietnam, Pakistan, and India, led to a sharp rise in global rice prices. It's worth noting that in August, ASEAN leaders and the ASEAN+3, a cooperative framework comprising ASEAN, Japan, South Korea, and China, agreed to limit export restrictions, underscoring the importance of maintaining stable rice trade flows.

On the other hand, there is growing concern about the potential negative impact of the El Niño phenomenon in the Pacific on rice production, particularly in the major rice-producing countries of South and Southeast Asia. Together, these regions contribute 58% of global rice production and are responsible for 80% of rice exports. The focus now is on how the El Niño phenomenon could affect rice yields in the coming months.

However, there remains a significant degree of uncertainty in predicting the exact impact of the El Niño phenomenon on rice production. Historical data suggests that past El Niño events, such as the one that occurred in 2018-2019, did not necessarily lead to a significant reduction in rice production levels.

The research paper emphasized that the true impact of the El Niño phenomenon on rice yields will unfold over the next 2-3 months, shedding light on the overall trend in the rice market. The paper urged governments to exercise caution and avoid excessive intervention to avoid a repeat of the rice price spikes of 2007 and 2008, which severely affected vulnerable rice-consuming households in Asia and Africa. Participants stressed the importance of restrained government intervention to maintain market stability and protect the interests of vulnerable communities.

Contributor: IIYAMA Miyuki (Information Program)