Calculation of rice farmers’ premiums for index-based flood insurance

Description

There is concern that climate change will induce extreme events such as severe droughts, high tides, and bigger cyclones. Thus, the development of non-life insurances products targeting crops is desired in the Ayeyarwady region in Myanmar, where cyclone Nargis caused severe damage in 2008. The development of weather index insurance is progressing because it does not require actual surveys of damaged areas, and farmers do not abandon cultivated areas impacted by a disaster. However, it is difficult for farmers to understand what crop insurance is and to calculate the insurance money needed to maintain farming operations. Therefore, this research aimed to provide a method to calculate the optimum insurance money for farmers.

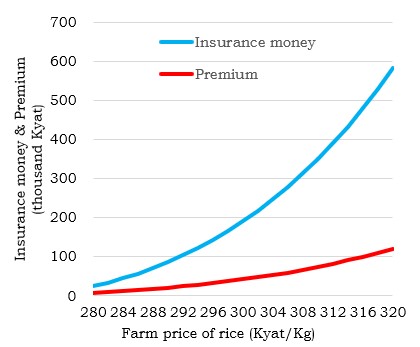

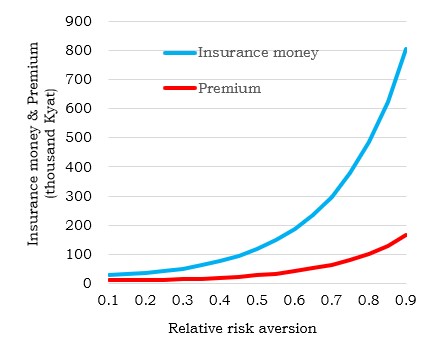

An insurance money function is derived by solving a utility maximization problem, taking into account the receipt of insurance money and premium payments for a risk averse farmer. The insurance money and the premium are found by substituting the average numbers of the 320-farm data (Table 1). These are shown to correspond to the farm price of rice and risk aversion rate of the farmer. If the relative risk aversion rate is zero, plus, and minus, the farmers are risk neutral, risk averter, and risk lover, respectively. If the farm price of rice goes up from 280 to 320 Kyat per kg, the annual premium that an average farmer with an average cropping area of 5.6 ha willingly pays will increase from 10,000 to 120,000 Kyat (Fig. 1). If the relative risk aversion rate rises from 0.1 to 0.9, the required insurance money will increase from 30,000 to 800,000 Kyat per average farmer (Fig. 2). If total rainfall from May to October is 3,700 mm which is the regional average; if the relative risk aversion rate is 0.68 which is the average number in Ethiopia in a previous research; and if the farm price of rice is 306 Kyat per kg which is the regional average, the premium will be 58,000 Kyat, i.e., around 42.6 USD per average farm. This calculated premium is equivalent to 3% of the average farm income.

Weather index insurance premiums can be calculated in response to changes in rainfall, relative risk aversion rate, farm price of rice, and input prices such as fertilizer price. The target disaster is flood. Flood disaster area rate during a period and marginal disaster area rate, which shows the rate of increase in disaster damage for 1 mm increase in rainfall, are required for application of the method to other regions.

Figure, table

-

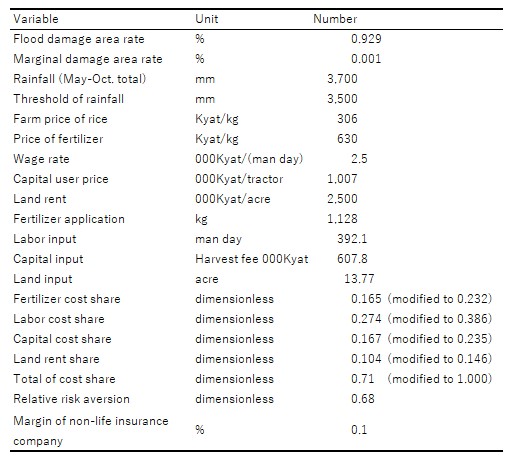

Table 1. Data for calculation of insurance money and premium (n=320

Note: 1 US Dollar = 1,360 Kyat, 108.8 JPY, in 2016 (survey period average), Relative risk aversion data is from a previous research in another country.

-

Fig. 1. Price of rice and premium

If the farm price of rice goes up, the demand for insurance will increase.

Note: Total rainfall from May to October is 3,700 mm, relative risk aversion is 0.68. -

Fig. 2. Risk aversion rate and premium

If the risk aversion rate is close to 1.0, the required insurance money will increase significantly.

Note: Total rainfall from May to October is 3,700 mm, price of rice is 306 Kyat/kg.Figures and table reprinted/modified Furuya et al. (2021) with permission.

- Classification

-

Technical

- Research project

- Program name

- Term of research

-

FY 2016–2020

- Responsible researcher

-

Furuya Jun ( Social Sciences Division )

MIERUKA ID: 001740Hirano Akira ( Social Sciences Division )

Swe Swe Mar ( Yezin Agricultural University )

Sakurai Takeshi ( University of Tokyo )

ORCID ID0000-0002-9007-4147KAKEN Researcher No.: 40343769 - ほか

- Publication, etc.

-

Furuya et al. (2021) Paddy and Water Environment 19: 319–330https://doi.org/10.1007/s10333-021-00859-2

- Japanese PDF

-

2021_A09_ja.pdf266.42 KB

- English PDF

-

2021_A09_en.pdf162.36 KB

- Poster PDF

-

2021_A09_poster.pdf187.86 KB

* Affiliation at the time of implementation of the study.